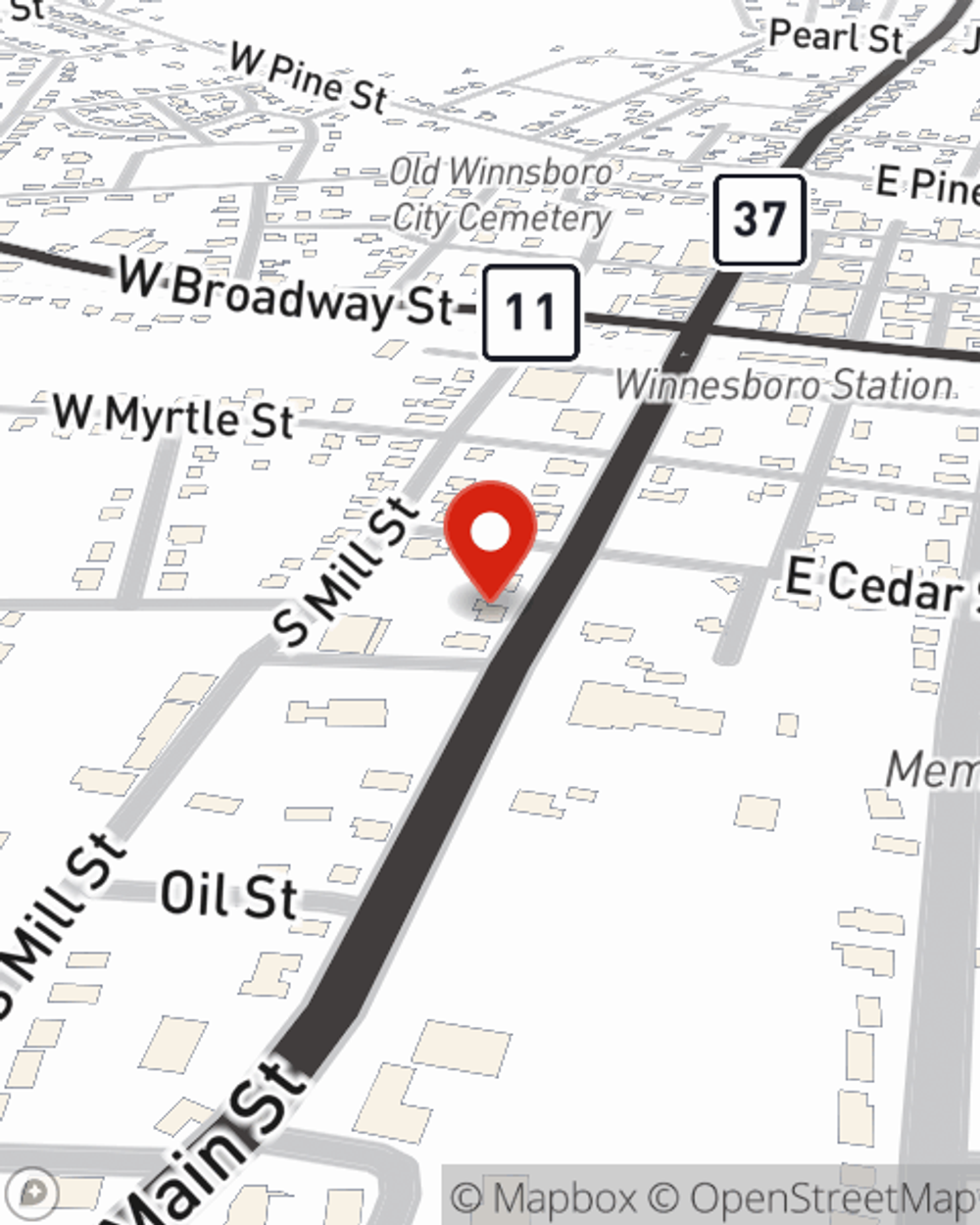

Business Insurance in and around Winnsboro

Looking for small business insurance coverage?

Cover all the bases for your small business

- Winnsboro

- Pittsburg

- Quitman

- Como

- Pickton

- Leesburg

- Scroggins

- Mount Vernon

- Saltillo

- Purley

- Sulphur Bluff

- Gilmer

- Franklin County

- Wood County

- Hopkins County

- Upshur County

Help Protect Your Business With State Farm.

Running a small business requires much from you. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, retailers, trades and more!

Looking for small business insurance coverage?

Cover all the bases for your small business

Get Down To Business With State Farm

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, builders risk insurance or worker’s compensation.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Bo Rester's team to discover the options specifically available to you!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Bo Rester

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.